Climate Change Initiatives

NTT UD REIT Investment Corporation’s Awareness of Climate Change

NTT UD REIT Investment Corporation (NUD) recognizes the following regarding climate change and improving the resilience of our business.

As shown by the Paris Agreement (2015), Intergovernmental Panel on Climate Change (IPCC) Special Report on Global Warming of 1.5°C (2018), IPCC Sixth Assessment Report (Working Group 1, 2021), and others, the advance of climate change is a scientific fact. It is an issue that will cause dramatic changes to the natural environment and social structure, significantly impacting our management and business as a whole.

We recognized that identifying, assessing, and managing the risks and opportunities caused by climate change and enhancing the resilience of our business are indispensable to ensuring sustainable, stable revenue for us over the long term.

Announcing Support for TCFD and Joining TCFD Consortium

NTT Urban Development Asset Management Corporation (UDAM), with the purpose of pursuing disclosure of information relating to climate issues, announced its support for the TCFD (Task Force on Climate-Related Financial Disclosures) in April 2022. At the same time as this announcement, it joined the TCFD Consortium. This consortium, which has been joined by many companies and organizations in Japan who have supported the TCFD, discusses matters such as the nature of climate-related information disclosure and how to use it. Through participation in the Consortium, UDAM proposes initiatives related to climate issues, the disclosure of related information, methods of using this information, etc. to the general public.

Basic Policy / Commitment

UDAM supports the international targets set forth in the Paris Agreement. In order to contribute to the mitigation of climate change, UDAM is committed to reducing greenhouse gas emissions and is aiming for net zero emissions by FY2050.

Governance

Regarding the structure for promoting sustainability at UDAM (including addressing climate change), please refer to the “Sustainability Promotion Structure”.

Strategy

Scenario Analysis

NUD has conducted multiple scenario analyses covering all owned properties.

Since the properties covered by the analysis may change in the future due to acquisition and disposition, the analysis results are also subject to change.

| Scenario | Risks | Referenced Information Sources | Scenario Overview |

|---|---|---|---|

| 4.0°C | Transition risks*1 | International Energy Agency (IEA) STEPS | Scenario in which existing policies or plans and agreements announced in recent years are implemented |

| Physical risks*2 | IPCC Fifth Assessment Report – RCP 8.5 | Scenario in which existing policies are relied on and global warming countermeasures surpassing the current ones are not implemented | |

| 1.5°C | Transition risks | IEA NZE 2050 | Scenario in which CO₂ emissions are reduced by about 40% by 2030 and net zero is achieved by 2050 |

| Physical risks | IPCC Fifth Assessment Report – RCP 2.6 | Scenario in the report with the lowest assumed temperature rise range |

| (Note 1) | Transition risks: Risks arising due to new regulations, taxation, technologies, etc. for the purpose of achieving a carbon-neutral society |

|---|---|

| (Note 2) | Physical risks: Risks arising due to climate change itself, such as changes in the weather |

Assumed Global Outlook

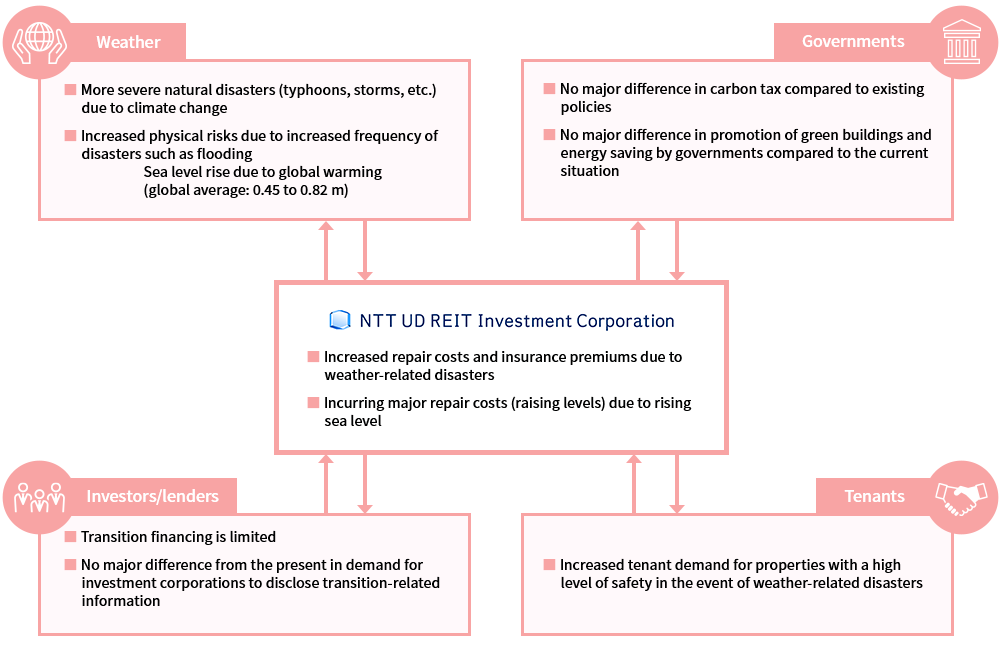

4.0°C Scenario

This scenario assumes that laws and regulations will not become stricter and while transition risks will be kept relatively low, because global initiatives aimed at carbon reduction do not progress, natural disasters will be more severe and physical risks will be extremely high.

Assumed Global Outlook

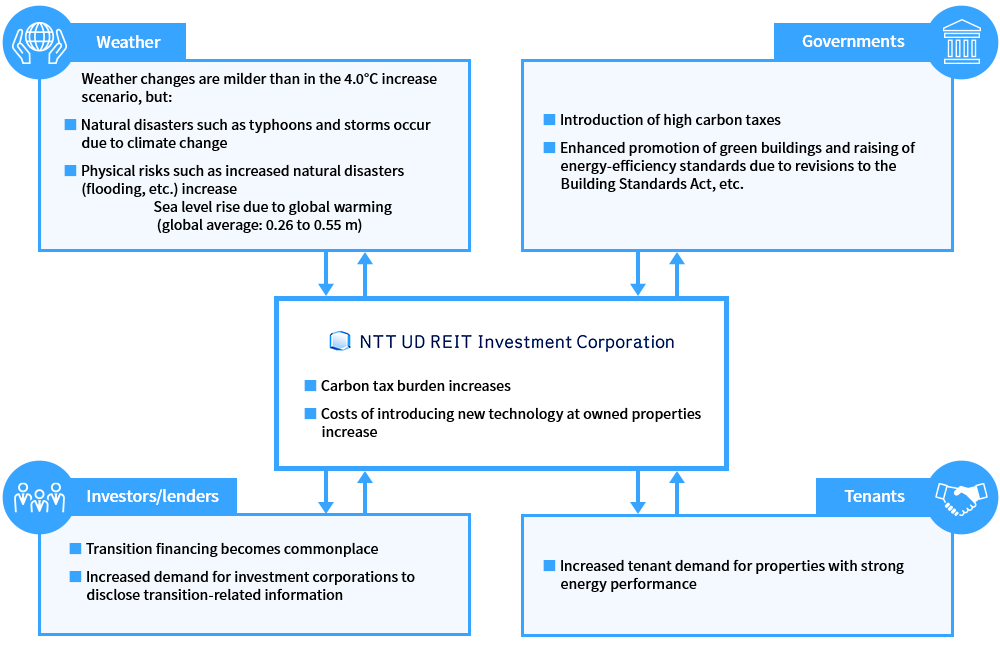

1.5°C Scenario

This scenario assumes that strict regulations, taxation, etc. will be implemented to achieve a carbon-neutral society and that greenhouse gas emissions will trend downward, so the physical risks will be low compared to the 4.0°C scenario while the transition risks will be high.

Identification of Risks and Opportunities and Countermeasures

NUD has identified risks and opportunities, identified scenarios, and assessed their business impact. The financial impacts were qualitatively assessed while referring to the scenarios described above.

Risks

| Category | Assumed Phenomenon | Financial Impact on NUD | 4.0°C Scenario | 1.5°C Scenario | Risk Management, Countermeasures, and Initiatives | ||

|---|---|---|---|---|---|---|---|

| Financial Impact | Financial Impact | ||||||

| Medium-term | Long-term | Medium-term | Long-term | ||||

| Transition Risks | |||||||

| Policy and legal | Increased taxation on GHG emissions due to introduction of carbon tax | Increased tax burden on properties’ GHG emissions | Small | Small | Large | Large |

|

| Enhancement of energy-efficiency standards for existing properties | Increased burden of renovation costs for purpose of adaptation (fines also a possibility) |

Small | Small | Medium | Large | ||

| Technology | Promotion and spread of renewable energy and energy-efficient technology | Increased costs for introducing new technology to prevent obsolescence of equipment | Small | Small | Medium | Large |

|

| Spread of energy creation | Increase in energy costs due to addition of energy-creation equipment costs | Small | Small | Large | Large | ||

| Markets | Introduction of standards for environmental performance, etc. in real estate appraisal | Decrease in funds’ NAV (Net Asset Value) | Small | Small | Small | Small |

|

| Worsening of lending requirements for market participants who have not adapted to climate change | Increase in financing costs | Small | Small | Medium | Large | ||

| Increase in utility costs (including procurement of renewable energy) | Increase in overhead | Small | Small | Large | Large | ||

| Changing tenant demands | Difficulty in acquiring new tenants and decreased retention | Small | Small | Medium | Large | ||

| Reputation | Decrease in brand value due to slow adaptation to climate change | Decrease in rent premium due to reduction of brand power | Small | Small | Medium | Medium | |

| Physical Risks | |||||||

| Acute | Wind and water damage to properties due to typhoons | Increase in repair costs/insurance premiums | Medium | Large | Small | Medium |

|

| Inland flooding due to intense rainfall, inundation due to flooding of nearby waterways, etc. | Decrease in occupancy rate in addition to the above | Medium | Large | Small | Medium | ||

| Chronic | Flooding damage due to sea level rise | Incurring major renovation costs (raising level) | Medium | Large | Small | Medium |

|

| Increased HVAC demand due to increase in extreme weather (e.g., heat waves, intense cold) | Increase in HVAC operation, maintenance, and repair costs | Medium | Large | Small | Medium | ||

Opportunities

| Category | Assumed Phenomenon | Financial Impact on NUD | 4.0°C Scenario | 1.5°C Scenario | Risk Management, Countermeasures, and Initiatives | ||

|---|---|---|---|---|---|---|---|

| Financial Impact | Financial Impact | ||||||

| Medium-term | Long-term | Medium-term | Long-term | ||||

| Opportunities | |||||||

| Policy and legal | Introduction of renewable energy on premises | Reduction of externally procured utility costs | Small | Small | Medium | Large |

|

| Introduction of water-saving equipment and highly energy-efficient equipment | Increased resilience to water stress | Small | Small | Medium | Medium | ||

| Technology | Appealing to tenants and users by offering low-emission facilities and services | Attracting tenants and maintaining occupancy | Small | Small | Medium | Medium | |

| Offering rental properties aligned with changing tenant preferences Reaching new clientele |

Increasing revenue by improving retention | Small | Small | Medium | Large | ||

| Markets | Reaching new investors | Increase in financing based on green finance, reduction in financing costs | Small | Small | Medium | Large | |

| Improving physical resilience of portfolio | Increased demand for safe properties that provide peace of mind | Medium | Large | Small | Medium | ||

Risk Management

UDAM manages NUD’s climate-related risks as indicated below.

Organizational Structure

Regarding UDAM’s organizational structure for managing climate-related risks, please refer to “Sustainability Promotion Structure”.

Management Process

- Regarding high-priority climate-related risks and opportunities that are important to business and financial planning which have been discussed by the Sustainability Promotion Committee, the chief climate officer guides the officers appointed in various relevant departments on developing proposals to address them.

- The proposals developed by the officers in the relevant departments are executed following discussion by the Sustainability Promotion Committee, according to their details.

- The chief climate officer supervises the risk identification, assessment, and management processes by providing guidance that factors in climate-related risks that are important to business and financial planning in the existing company-wide risk management program as well.

Metrics and Targets

NUD has established the following key performance indicators (KPIs) to monitor our response to environmental issues.

- 42% reduction in greenhouse gas (CO₂) emissions (Scope 1 and 2) intensity by FY2030 (vs. FY2020)

- Achieving net zero greenhouse gas (CO₂) emissions (Scope 1, 2, and 3 total emissions) by FY2050