Corporate Governance

Structure of NUD

For details, please refer to the following.

Structure of Investment Corporation

The Articles of Incorporation of NUD provides that NUD shall have at least two Executive Directors and at least three Supervisory Directors (provided, however, that the number of Supervisory Directors shall be at least one more than the number of Executive Directors). The structure of NUD is made up of the General Meeting of Unitholders composed of unitholders, one Executive Director, two Supervisory Directors, the Board of Directors with all Executive Directors and Supervisory Directors as board members, and the Accounting Auditor.

For details, please refer to the following:

- January 30, 2024 Structure of Investment Corporation (Japanese) PDF

Management Structure

As an investment corporation, NUD manages funds, etc. paid in by the unitholders as investments in real estate, securities including beneficiary interests in real estate trusts, and other assets.

Management of the assets of NUD is in accordance with an asset management agreement under which, as an asset management company, NTT Urban Development Asset Management (UDAM) manages assets owned by NUD based on the Articles of Incorporation of NUD.

For details, please refer to the following:

- January 30, 2024 Report on Management Structure and System of the Issuer of Real Estate Investment Trust Units, etc. (Japanese) PDF

Compliance Initiatives

■ Basic Views on Compliance

Asset management and other operations concerning the financial instruments business are acts of managing the funds of investors who invest in NUD, and NUD understands the importance of such acts. In order to establish an appropriate management structure, NUD has set up a Compliance Office in its Asset Management Company as a department responsible for matters concerning compliance and appointed a Compliance Officer as an individual responsible for supervising matters concerning compliance. Through these efforts, NUD is securing the effectiveness of the internal check-and-balance system for other departments.

The Compliance Officer constantly monitors the execution of business in asset management and other financial instruments businesses to ensure that it is based on laws and regulations, NUD’s Articles of Incorporation and other various rules, and monitors and supervises the status of compliance in daily business execution as well.

■ Matters Considered and Characteristics of Management Structure, Etc.

NUD provides compliance standards in the “Compliance Rules,” which are internal rules of NUD, as the basic policy on corporate ethics and the code of conduct for Executive Directors and Supervisory Directors of NUD serving as the guide for securing soundness in management based on self-discipline while performing corporate activities in a sincere and fair manner in strict compliance with laws, regulations and rules in the operation of business. Compliance standards provided include: (i) Awareness of social responsibility and public mission, and strict compliance with laws, regulations and other rules; (ii) Firm stance against anti-social forces; (iii) Thoroughly ensuring the principles of self-responsibility; (iv) Prohibiting granting of favors, etc. to interested parties, etc.; (v) Drawing a line between public and private matters; (vi) Thoroughly ensuring information management; and (vii) Prohibiting conflicts of interest. Along with each officer’s strict compliance with not only the “Compliance Rules” but also laws, regulations, market rules, internal rules and other various rules, business is operated in accordance with the “Rules to Prevent Insider Trading,” which are internal rules for preventing, etc. insider trading, and such in pursuit of robust governance.

Risk Management Initiatives

For the key matters posing as potential risk factors of investment in NUD investment securities and for the investment risk management structure, please refer to “Investment Risks” on the “Information for Unitholders” page of this website.

Securement of Operating System in Consideration of the Interests of Unitholders

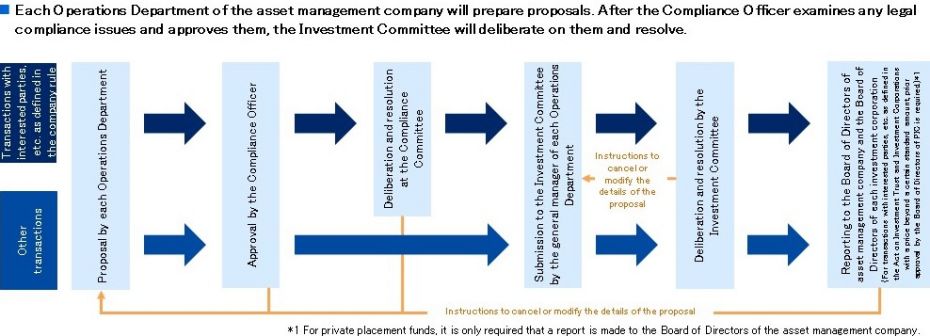

■ Decision-Making Process for Property Acquisition and Sale

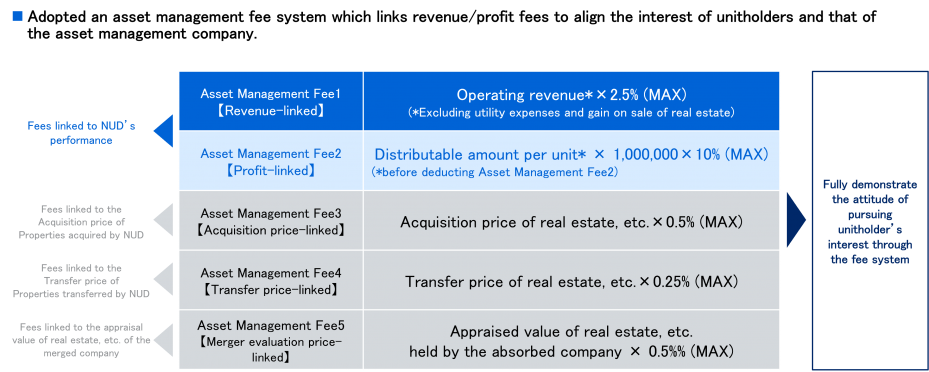

■ Management Fee System of the Asset Management Company

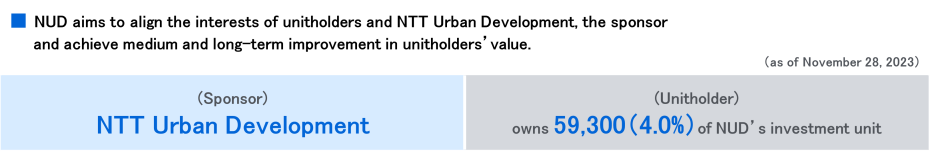

■ Same-Boat Investment by the Sponsor